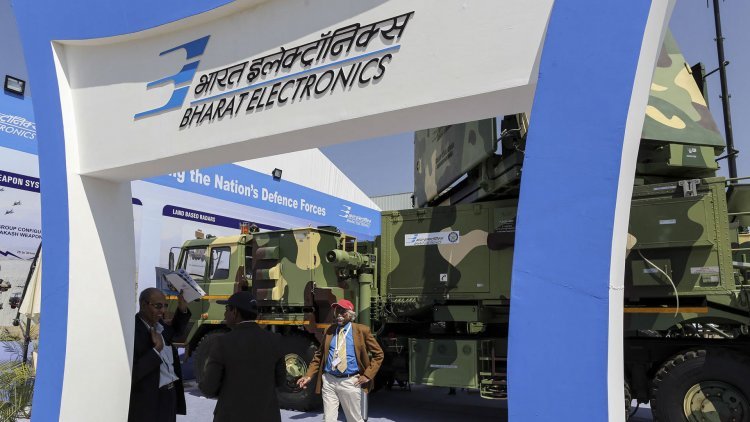

Bharat Electronics shares increase on solid third-quarter earnings results

The Navratna defence PSU said that as of October 1, 2022, it had an order book of Rs 52,795 crore.

Bharat Electronics reported a respectable set of earnings for the three months ended September 30 with solid revenue visibility supported by a healthy order book, and the company's shares closed 2.7 percent higher at Rs 108 on October 27.

Higher input costs had an impact on the company's standalone profit after tax, which fell 0.25 percent to Rs 611.05 crore from the prior quarter. Standalone operating revenue increased 7.8% year over year to Rs 3,946 crore, driven by strong order book execution.

The Navratna defence PSU reported that as of October 1, 2022, it had orders worth Rs 52,795 crore.

Analysts kept their "buy" recommendation for the stock.

"In difficult times, Bharat Electronics produced a respectable result in Q2FY23. 3.1 times TTM (trailing twelve month) sales in the order book provides a solid revenue visibility "Senior Research Analyst at Reliance Securities, Arafat Saiyed, stated. However, the amount of orders received in Q2FY23 fell by 62 percent to Rs 1,420 crore.

Operatingly, earnings before interest, tax, depreciation, and amortisation (EBITDA) were unchanged at Rs 856 crore, and the margin for the September FY23 quarter decreased 171 basis points (bps) year over year to 21.68 percent, which was close to the upper range of management guidance of 20-22 percent.

Standalone profit grew 67 percent to Rs. 1,042.5 crore in the six-month period that ended on September 30 while operating revenue increased 33 percent to Rs. 7,058.6 crore.

Reliance Securities kept its optimistic outlook on BEL's long-term prospects due to the company's high defence spending, solid knowledge of and connections to governmental organisations, and diversification into non-defence operations.

Due to business prospects in the defence and non-defence sectors, the brokerage anticipates that the company will register double-digit growth over the next couple of years.

It added the company's debt-free balance sheet, effective working capital management, adequate investment in R&D, adoption of new technologies, track record of prompt completion of major projects, solid cash flow, and wise capital allocation bode well for the business.

According to Saiyed, the stock has a "buy" rating from Reliance Securities.

The stock is given a "buy" rating by Prabhudas Lilladher as well, with a target price of Rs 125.

Disclaimer: The opinions and investment advice given by professionals on Moneycontrol are their own and do not represent the position of the website or its administration. Before making any investing decisions, Moneycontrol recommends customers to seek the advice of qualified professionals.

admin

admin