D-Street risks surge as investors become concerned ahead of the Budget

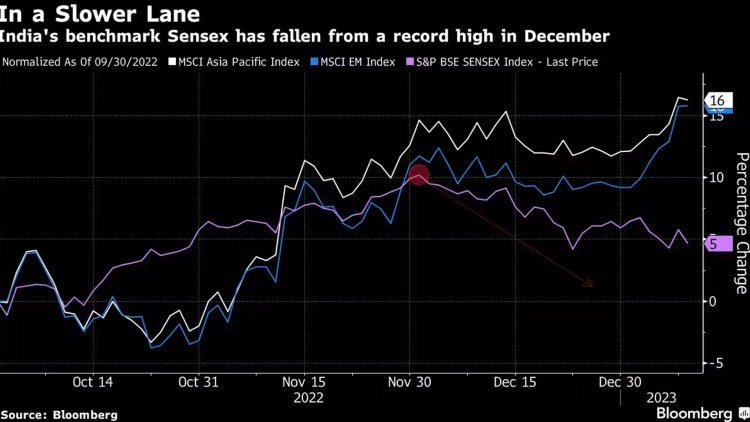

After outperforming most Asian and developing market rivals last year, India's $3.4 trillion stock market will be overshadowed in 2023 as China reopens, attracting global money to the North Asian market following a historic selloff.

Stock investors in India are prepared for a difficult few weeks before the government's federal budget is unveiled next month, as economic growth slows from a high and foreigners resume selling weight on local shares.

After outperforming most Asian and developing market rivals last year, India's $3.4 trillion stock market will be overshadowed in 2023 as China reopens, attracting global money to the North Asian market following a historic selloff.

Based on statistics provided by Bloomberg Intelligence, India's equities are anticipated to witness quiet trading ahead of the government budget reading, which is normally held on Feb. 1, with an average decrease of 1% since 2003 in the month preceding the budget.

China stocks are trading at substantially lower values than their South Asian peers this year, encouraging global funds to opt for a "tactical rotation," according to Bloomberg Intelligence analyst Nitin Chanduka. "India trades at a forward PE of 20 times, which is nearly double that of Chinese shares. "The decision is simple."

The benchmark S&P BSE Sensex Index in India has lost 5% since its all-time high in December, with foreign funds net selling $595 million of local shares this month to Jan. 9. Individual investors rushed into the country's stocks during the pandemic, outperforming most major markets.

"The selloff by foreign investors is picking up speed, but the concern is that they are decreasing stakes across sectors, including banks," said Abhay Agarwal, fund manager at Mumbai-based Piper Serica Advisors Pvt. India received a large percentage of global flows in 2022, but this is unlikely to happen again this year, he noted.

admin

admin