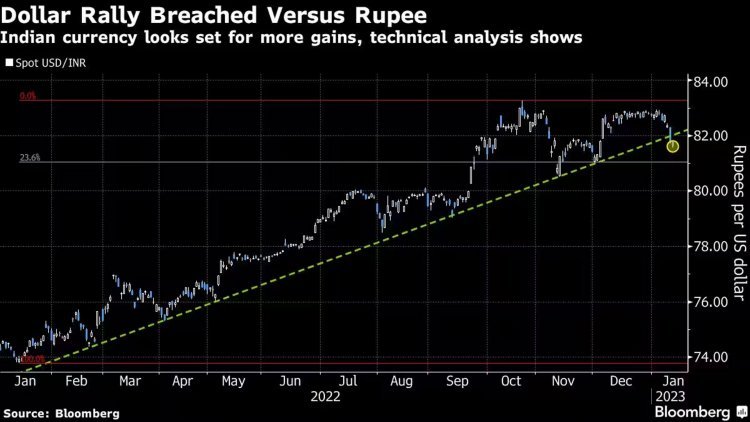

The rupee's violation of the trendline paves the way for more increases

On Tuesday, the dollar-rupee closed below an uptrend that had been in place since the beginning of 2022, indicating a bearish technical indication for chart observers.

The Indian rupee has broken through a year-long trendline, paving the way for further short-term advances as investors turn their attention to the approaching federal budget.

On Tuesday, the dollar-rupee closed below an uptrend that had been in place since the beginning of 2022, indicating a bearish technical indication for chart observers. According to Fibonacci analysis, the next level of support for the pair is at 81 per dollar, with a breach pointing to the 80 level last hit in August.

The rupee gained for the third day in a row on Wednesday. "The rupee may see further rises," said Abhishek Goenka, CEO of India Forex Advisors.

Since the latter half of last year, India's rupee has underperformed, pushed down by concerns over the country's large current account deficit. Despite a drop in crude oil prices, it has trailed behind its developing Asian peers as the country's central bank scooped up dollars to buttress its reserves.

In the final full-year expenditure plan of Prime Minister Narendra Modi's government before elections in 2024, the early-February budget will indicate India's priorities for the year.

admin

admin