PhonePe has begun creating its own payment gateway

The business might sell its payment gateway services to major offline firms. Additionally, the venture will make it possible for PhonePe to provide in-app purchases, decreasing its reliance on third-party payment processors.

As an addition to its current Quick Response (QR) Code-based UPI payment service and in-app payments, the leader of the Unified Payments Interface (UPI), PhonePe, is launching its own payment gateway. According to sources, the company will be in direct competition with companies like Paytm, Pine Labs, and Razorpay as it may look to target both large offline players and small and medium-sized businesses to offer its payment gateway to.

"PhonePe had been putting some time into this. They announced that they are developing a payment gateway to their payment processors about two months ago. Since they will be in competition with them, they had contacted payment partners in good faith, according to a payments executive who is aware of PhonePe's ambitions.

Despite declining to comment on the news, the Walmart-backed company recently added a link for its payment gateway to its website as one of the services it provides to businesses.

Currently, PhonePe processes payments for retailers using an interface that gives customers the choice of paying with their saved credit card, debit card, or UPI. A payment gateway will assist the business's in-app payments in addition to helping it onboard external merchants.

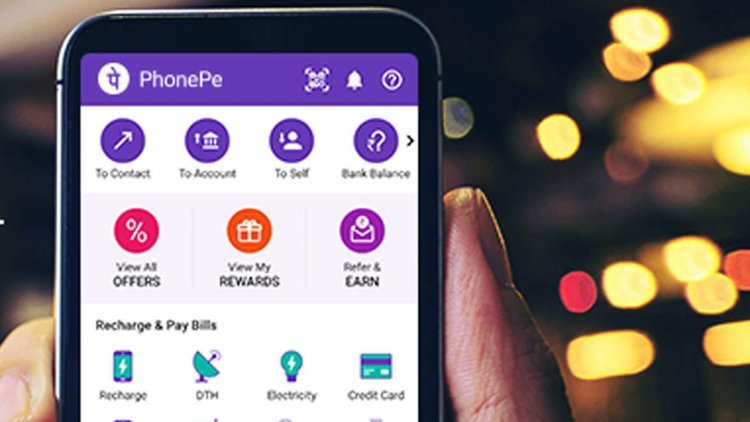

The PhonePe app supports UPI in addition to ticket and bill payments, rent and bill payments, and insurance purchases.

"PhonePe sees huge volumes on its app for bill and rent payments," another official from a payments company stated. The business now relies on external payment gateways for numerous transactions. By having its own payment gateway, it will rely less on external gateways.

The business is currently waiting for the Reserve Bank of India (RBI) to approve its application for a payment aggregator licence. According to industry players, the company can run a payment gateway in the interim while waiting for the licence, just like other participants in the market.

PhonePe has been quickly growing both its payment and ancillary services. On August 3, Moneycontrol had claimed that the business had also introduced a speaker device for retailers that would alert them when a payment had been received using its app.

PhonePe competed against rival Paytm, the third-largest UPI provider, by releasing this option at a reduced pricing.

Rising level of competition

There are an increasing number of payment gateway providers fighting for market share among large firms that offer payment services. Large players have embraced an omnichannel approach as the distinctions between the experience in payments for online purchases and physical payments at stores become more hazy.

Leader in point of sale (PoS) payments Pine Labs acquired Mumbai-based startup Qfix over the past year in addition to launching its own payment gateway, Plural.

In order to expand its omnichannel payments capabilities, Razorpay, a leader among startup and tech firms for its payment gateway, bought PoS player Ezetap in August. Players like Infibeam Avenues have started implementing their omnichannel strategies, while MSwipe, a PoS player, will shortly deploy its payment gateway, but it will only be available to small and medium-sized businesses.

All three competitors are probably aiming for the same merchants now that PhonePe has entered the game as well. While Pine Labs has been concentrating on online payments of huge retail chains that it provides PoS terminals to, Razorpay may aim to capture the offline forays of online-only firms that are already its customers.

Along with focusing on digitalizing its current clientele of small and medium-sized businesses to which it offers QR Code-based payments, PhonePe may also consider a similar strategy.

After the purchase of Ezetap, Razorpay co-founder and CEO Harshil Mathur spoke with Moneycontrol on August 18 and discussed the company's goals to grow into the largest omnichannel payments provider.

"With so many businesses vying for the same clients, the rivalry in this market is going to heat up. However, because brands frequently use various gateways and payment providers, it is not a well defined area. The offering will ultimately determine which provider has a larger omnichannel share, according to the CEO of a payments services business.

admin

admin